Every week, Features Editor Lily Firth hits the archives and finds old Signals that relate to current College topics and top stories.

College tuition and other fees often increase annually, making the burden of accumulating debt heavier for students and their families. This financial strain is amplified by the time constraints of vigorous classes and extracurricular activities, making it difficult for students to find and work at a well-paying job. In 1987, students at the College were also struggling to budget their money properly and pay off student loans.

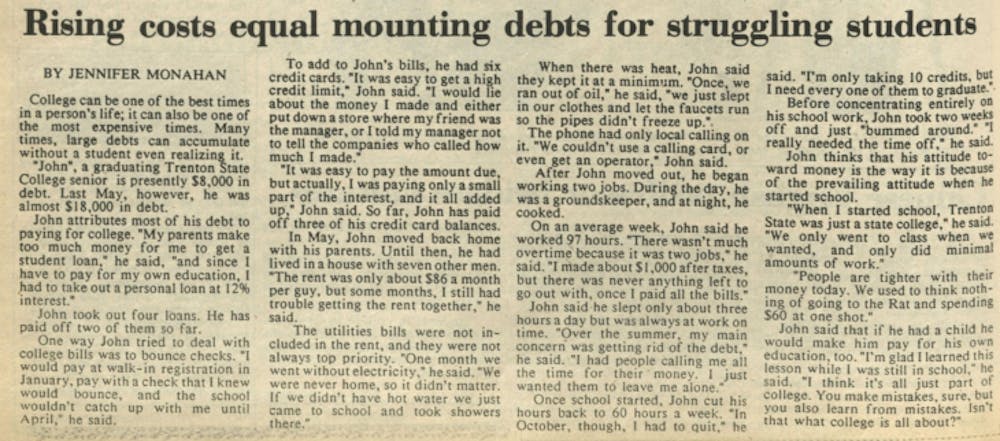

College can be one of the best times in a person's life; it can also be one of the most expensive times. Many times, large debts can accumulate without a student even realizing it. "John", a graduating Trenton State College senior is presently $8,000 in debt. Last May, however, he was almost $18,000 in debt.

John attributes most of his debt to paying for college. "My parents make too much money for me to get a student loan," he said, "and since I have to pay for my own education, I had to take out a personal loan at 12% interest."

John took out four loans. He has paid off two of them so far.

One way John tried to deal with college bills was to bounce checks. "I would pay at walk-in registration in January, pay with a check that I knew would bounce, and the school wouldn't catch up with me until April," he said.

To add to John's bills, he had six credit cards. "It was easy to get a high credit limit," John said. "I would lie about the money I made and either put down a store where my friend was the manager, or I told my manager not to tell the companies who called how much I made."

"It was easy to pay the amount due, but actually, I was paying only a small part of the interest, and it all added up," John said. So far, John has paid off three of his credit card balances.

In May, John moved back home with his parents. Until then, he had lived in a house with seven other men. "The rent was only about $86 a month per guy, but some months, I still had trouble getting the rent together," he said.

The utilities bills were not included in the rent, and they were not always top priority. "One month we went without electricity," he said. "We were never home, so it didn't matter. If we didn't have hot water we just came to school and took showers there."

When there was heat, John said they kept it at a minimum. "Once, we ran out of oil," he said, "we just slept in our clothes and let the faucets run so the pipes didn't freeze up."

The phone had only local calling on it. "We couldn't use a calling card, or even get an operator," John said.

After John moved out, he began working two jobs. During the day, he was a groundskeeper, and at night, he cooked.

On an average week, John said he worked 97 hours. "There wasn't much overtime because it was two jobs," he said. "I made about $1,000 after taxes, but there was never anything left to go out with, once I paid all the bills."

John said he slept only about three hours a day but was always at work on time. "Over the summer, my main concern was getting rid of the debt," he said. "I had people calling me all the time for their money. I just wanted them to leave me alone."

Once school started, John cut his hours back to 60 hours a week. "In October, though, I had to quit," he said. "I'm only taking 10 credits, but I need every one of them to graduate. Before concentrating entirely on his school work, John took two weeks off and just "bummed around." "I really needed the time off," he said.

John thinks that his attitude toward money is the way it is because of the prevailing attitude when he started school.

"When I started school, Trenton State was just a state college," he said. "We only went to class when we wanted, and only did minimal amounts of work."

"People are tighter with their money today. We used to think nothing of going to the Rat and spending $60 at one shot." John said that if he had a child he would make him pay for his own education, too. "I'm glad I learned this lesson while I was still in school," he said. "I think it's all just part of college. You make mistakes, sure, but you also learn from mistakes. Isn't that what college is all about?"