By Isabella Darcy

Editor-in-Chief

Two years after launching a financial recovery plan, the College has stabilized its budget and is expected to be financially stable in the long-term, according to administrators.

The plan for “Linking Innovation with Operational Nimbleness and Sustainability,” better known as the LIONS Plan, was implemented by The College’s President Michael Bernstein in December 2023. It addresses financial challenges through initiatives that generate revenue and reduce spending.

The College was sitting on just over $360 million in debt in June 2023, according to S&P Global Ratings, a credit rating agency. That number has since been reduced to $353 million. The debt is not due all at once, which gives the College time to cover it through annual budgeted payments, according to Qadim Ghani, the College’s chief financial officer.

“Debt is a part of doing business,” Bernstein told The Signal. “There’s nothing in the projections that tell us we’re not going to be able to manage this debt, and over time not be able to pay it down.”

Much of the College’s debt was taken on to fund the construction of new buildings, and to make investments in new programs and facilities, according to Bernstein.

For major expenses, like building construction and maintenance, the College has traditionally used state appropriations for financial support. Over the past decade, funding such projects has become a greater burden. State funding for the College has been sparse and slower in growth than at other public colleges and universities in New Jersey.

Members of the campus community have been lobbying state legislators for more funding. Additionally, the College’s government affairs and community relations officers are working with elected officials to make sure they continue to be aware of the institution's needs and asks, according to Bernstein.

The College’s situation contrasts from some other institutions in the state, which are experiencing severe financial distress. Following a years-long “financial emergency,” New Jersey City University recently agreed to merge with Kean University in July 2026. Two miles from the College, Rider University is facing a financial crisis that has led to significant restructuring.

The College has been able to avoid similar dire situations because of the joint effort between everyone in the campus community, according to Dave Muha, the vice president for college advancement.

The effort, however, has not always been comfortable. Students struggled to make their schedules for multiple semesters, because course offerings were reduced. Staff, faculty and administrative personnel experienced increased workloads during a temporary hiring freeze that was initiated for budgetary reasons and has since ended.

“We have more work to do,” Muha said. “But, we’re on a solid foundation financially.”

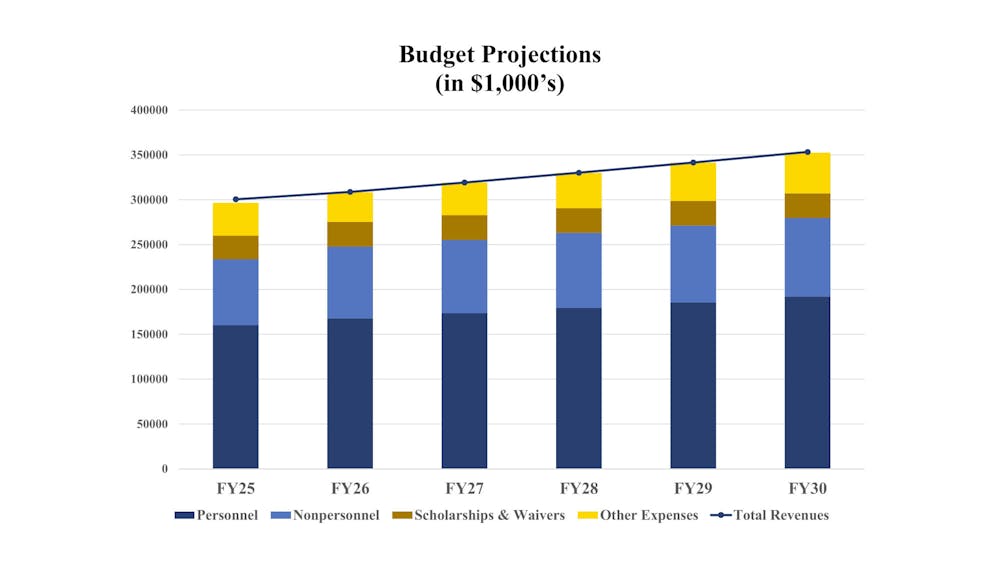

(Chart courtesy of Dave Muha)

The College’s Finance and Business services team is projecting a five-year balanced budget, meaning total income would equal total spending through fiscal year 2030. To continue its forward momentum, the team is monitoring the revenue-generating initiatives that are already in place and exploring new solutions, including a large fundraising campaign that is expected to kick-off early next year.